To facilitate cross-boundary investment by individual residents in the Guangdong-Hong Kong-Macao Greater Bay Area (the “Greater Bay Area”), on June 29, 2020, the People’s Bank of China (“PBOC”), the Hong Kong Monetary Authority (“HKMA”) and the Monetary Authority of Macao (“MAM”) jointly issued an announcement (“Announcement”) on the launch of the cross-boundary wealth management connect pilot scheme (“Wealth Management Connect”) in the Greater Bay Area. The date of formal launch of Wealth Management Connect and implementation details will be separately specified.

Wealth Management Connect and the current Stock Connect, Bond Connect and Mutual Recognition of Funds (“MRF”) schemes between Mainland and Hong Kong have both similarities and differences in some aspects. As both MRF and Wealth Management Connect are typical asset management businesses, we will have a brief analysis of the Announcement by comparing these two schemes.

- Quota

Cross-boundary fund flows under Northbound and Southbound Wealth Management Connect will be subject to aggregate and individual investor quota management. The aggregate quota will be adjusted through a macro-prudential coefficient.

Specific quota control mechanism is yet to be provided in relevant implementation rules.

|

Connect Scheme |

Quota Management |

|

MRF |

Aggregate quota |

|

Wealth Management Connect |

Aggregate quota + individual investor quota |

- Cash Flow

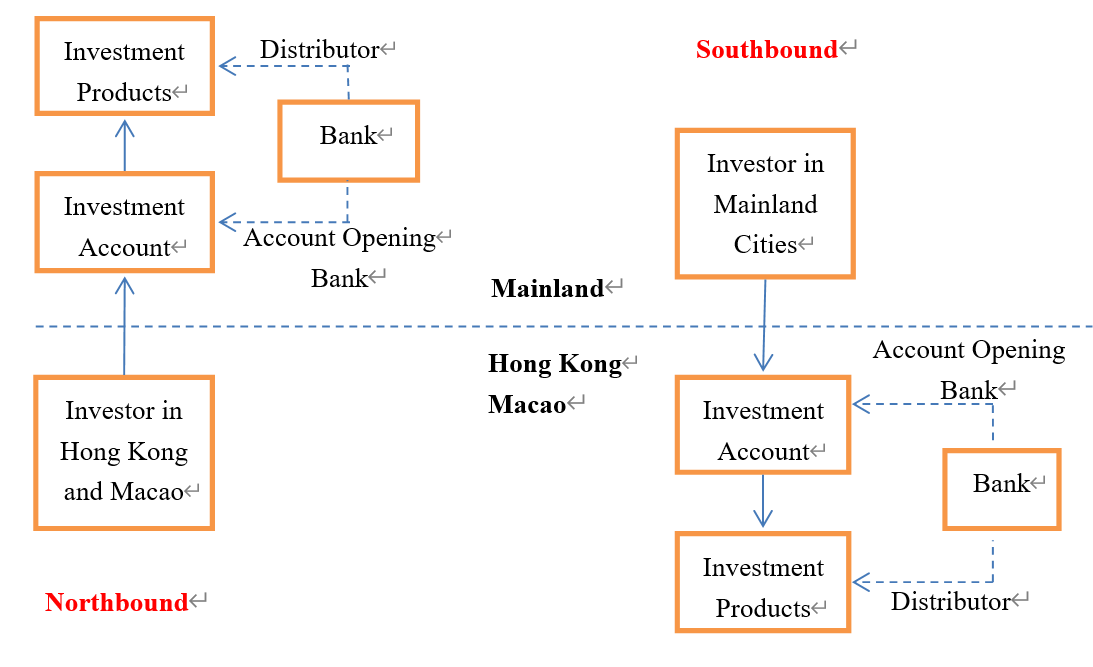

Mainland cities in the chart refer only to the 9 cities in the Greater Bay Area, including Guangzhou, Shenzhen, Zhuhai, Foshan, Huizhou, Dongguan, Zhongshan, Jiangmen and Zhaoqing.

- RMB and Foreign Exchange

Cross-boundary remittance under Wealth Management Connect will be conducted and managed in a closed-loop through the bundling of designated remittance and investment accounts to ensure that the relevant funds will only be used to invest in eligible investment products. Cross-boundary remittances will be carried out in RMB, with currency conversion conducted in the offshore markets.

|

Connect Scheme |

Cross-boundary Remittances |

|

MRF |

In RMB or foreign currencies |

|

Wealth Management Connect |

In RMB; currency conversion in the offshore markets |

- Implementation Details

PBOC, the China Banking and Insurance Regulatory Commission (“CBIRC”), the China Securities Regulatory Commission (“CSRC”), the State Administration of Foreign Exchange, HKMA, the Hong Kong Securities and Futures Commission (“SFC”) and MAM (collectively, the “Regulators”) will discuss and agree on the implementation details on investor eligibility, mode of investment, scope of eligible investment products, investor protection, handling of disputes, etc.

- Eligible Investors

|

Connect Scheme |

Investors |

|

MRF |

No investor eligibility requirement under MRF scheme; open to retail investors.

|

|

Wealth Management Connect |

Eligible investors only; specific requirement to be decided. |

- Mode of Investment

|

Connect Scheme |

Mode of Investment |

|

MRF |

Taking Northbound MRF as an example, a Mainland agent shall be engaged by the manager of recognized Hong Kong fund to handle such matters as product registration with CSRC, information disclosure, distribution arrangement, data exchange, capital clearing, regulatory reporting, communication and liaison, customer service and monitoring. The manager of any recognized Hong Kong fund may handle by itself or entrust the Mainland agent to handle the signing of the fund distribution agreement with distributors in the Mainland. The Mainland agent, or fund distributors, or other qualified institutions, shall be appointed as the nominee holder of fund units held by investors in the Mainland.

|

|

Wealth Management Connect |

Details to be decided; the role and function of the banks are key issues (e.g., whether the banks will be allowed to provide investment advice, or even have investment discretion). |

- Scope of Eligible Investment Products

|

Connect Scheme |

Eligible Investment Products |

|

MRF |

Unit trust, mutual fund or collective investment scheme in other forms, established, operated and sold in Hong Kong in accordance with Hong Kong laws and publicly sold in the Mainland upon the approval of CSRC.

|

|

Wealth Management Connect |

Details to be decided. In the English version of the Announcement issued by HKMA, the investment products to be sold to residents in the Greater Bay Area are called “retail wealth management products”, which seems to us that private asset management products targeting high-net-worth individuals only have been excluded. It is yet to be clarified in relevant implementation rules.

As both CBIRC and CSRC are involved as the Regulators, Wealth Management Connect features individual investment (rather than institutional investment), and both retail wealth management products of commercial banks and wealth management subsidiaries regulated by CBIRC and retail funds regulated by CSRC can be sold to retail investors, it is expected that both retail wealth management products and retail funds are likely to be included in the eligible investment products under Northbound Wealth Management Connect.

It remains to be seen whether investors will only be allowed to invest in the eligible investment products managed by the banks (or their subsidiaries), or they can invest in all eligible investment products distributed by the banks.

|

- Investor Protection and Handling of Disputes

|

Connect Scheme |

Investor Protection and Handling of Disputes |

|

MRF |

The prospectus and key facts statement for a recognized Hong Kong fund in the Mainland shall be prepared in accordance with regulatory requirements of SFC, and be supplemented with specific contents for Mainland investors according to relevant rules and guidance by CSRC.

The fund manager shall take reasonable measures to ensure that Hong Kong investors and Mainland investors are accessible to fair treatment, including the protection of the investors' rights and interests, the exercise of the investors' rights, information disclosure and compensation.

Any dispute arising from or in connection with any recognized Hong Kong fund shall be settled in the method provided in relevant fund contract. If the parties adopt litigation as the dispute resolution method, the Mainland court shall not be excluded from hearing the relevant proceedings.

|

|

Wealth Management Connect |

Similar requirements under MRF may also be in place under Wealth Management Connect, but details are yet to be decided.

If there is any nominee holding arrangement, relevant issues shall be further clarified.

|

- Advantage of Wealth Management Connect

Wealth Management Connect is an important supplement to the current asset management channels, and will bring many benefits for individual investors in the Great Bay Area.

Compared with investment through QDII, RQDII, QDLP and QDIE schemes, investment by Mainland investors under Southbound Wealth Management Connect is a direct investment. Similarly, compared with investment through QFII and RQFII schemes, investment by Hong Kong and Macao investors under Northbound Wealth Management Connect is also a direct investment.

Mainland investment products available to Hong Kong investors under MRF are limited to retail funds regulated by CSRC, while those under Wealth Management Connect may also include retail wealth management products regulated by CBIRC.

Hong Kong funds to be sold to Mainland investors under MRF shall register with CSRC first, and the process takes months at least; for Hong Kong fund managers, the 50%-50% requirement (i.e., the sales volume of each recognized Hong Kong fund in the Mainland shall not account for more than 50% of its total fund assets) under MRF has some impact on their fund distribution in the Mainland. Hopefully, there will not be such requirement under Wealth Management Connect.

- Challenges

Wealth Management Connect will be governed by the respective laws and regulations on retail wealth management products applicable in the three places with due regard to international norms and practices. It remains to be seen how the Regulators translate such principle into implementation details.

With respect to such issues as KYC, AML, CRS, investor suitability and etc., it is challenging for both the Regulators to formulate implementation details and the parties involved (e.g., the banks, the investors and the managers of the investment products) to practice them.

* * *

Please kindly note that this Memo is rendered mainly with respect to relevant laws and regulations of the PRC (for purposes of this Memo only, the PRC does not include Hong Kong, Taiwan or Macau) in effect as of the date of this Memo. This Memo is being furnished solely to you for your reference purposes only.

Jingtian & Gongcheng Investment Funds & Asset Management Group has vast experience with asset management business in China, including cross-border asset management business (e.g., QFII, RQFII, QDII, RQDII, QDLP, QDIE, QFLP, RQFLP, Stock Connect, CIBM Direct, Bond Connect and MRF). In September 2019 and March 2020, Jingtian & Gongcheng received international recognition by garnering the China Investment Fund Law Firm of the Year Award from China Law & Practice and Asia Firm of the Year from The Asian Lawyer under leading international legal publishing group ALM, respectively.

Should you have any further questions, please feel free to contact Messrs. James Yong Wang and Eric Ye Zou below.