China formally removed the foreign ownership limit of securities companies on April 1, 2020, and eligible foreign financial institutions may apply for establishment of fully foreign-owned securities companies (“WFOE securities companies”). Previously, the China Securities Regulatory Commission (“CSRC”) declared on July 5, 2019 that it had resumed reviewing application for establishment of domestic securities companies, after several years’ suspension. After such opening-up, more foreign-invested and domestic securities companies are expected to join and play in the financial market of China.

This memo is to help you better understand relevant regulations and practical considerations on setting up a securities company in China, based on our practical experience.

Section IHistory of Opening-up

|

Year |

Opening-up Policy |

Representative Foreign Institution |

|---|---|---|

|

2002 |

Foreign ownership limit set as one third. |

Citibank and JP Morgan |

|

2012 |

Foreign ownership limit lifted to 49%. |

Morgan Stanley |

|

2015 |

Under CEPA[1] route only, one joint venture securities company is permitted to set up in Shanghai, Guangdong and Shenzhen respectively, with eligible Hong Kong and Macao financial institutions holding at most 51% of its equity interests. |

HSBC |

|

2018 |

Foreign ownership limit lifted to 51%. |

UBS AG |

|

2020 |

Foreign ownership limit removed. |

|

Section IIJV or WFOE

Joint Venture (“JV”) securities companies were not popular in the past because:

- Foreign ownership limit has been below 50% for a long time, so that foreign shareholders were not able to control the securities companies.

- According to previous rules in effect before 2018, a JV securities company must have a domestic shareholder that is a securities company and holds at least 49% equity interests.

- If the domestic securities company holds 51% equity interests, the JV will constitute its subsidiary; and, according to applicable rules, a securities company and its subsidiaries shall have different business scope in order to avoid competition in the same business sector.

There is no such concern anymore after 2018.

A WFOE securities company has certain advantages, but a JV is still popular. For example, Nomura and JP Morgan set up JV securities companies in 2019, with foreign ownership of 51%. They have not chosen to wait and set up a WFOE in 2020, which well demonstrated that JV has its special advantages (e.g., the domestic shareholder may recommend clients or other business opportunities to the JV).

Section IIICategorization of Securities Companies

According to the Q&A of CSRC, based on the risk profile and complexity of a securities company’s business model, securities companies are divided into two categories by applicable rules.

|

Category |

Introduction |

|---|---|

|

Specialized securities companies |

Engaging in traditional securities-related businesses, such as brokerage, securities investment consultancy, financial advisory service, securities underwriting and sponsoring, and proprietary securities trading. The nature of their business centers on intermediary activities as an agency without incurring heavy burdens of debts on their own accounts or matchmaking for large capitals, exhibiting low levels of externalities. |

|

Comprehensive securities companies |

Taking leveraged positions on their own accounts and be exposed to cross-businesses risks. In addition to traditional securities-related undertakings, these companies generally also participate in complex and highly capital-consuming operations that are closely intertwined with other sectors of the financial system, such as market making for stock options, OTC derivatives trading, stock pledge and repurchase. Due to the significant externalities in their business model, the major shareholders and controlling shareholders of comprehensive securities companies must have competent management controls and the ability to replenish capital in time of need. |

The categorization as “specialized” or “comprehensive” is interchangeable after fulfilling due approval procedures.

Section IVEligibility Requirements of Shareholder

- Types of Shareholders

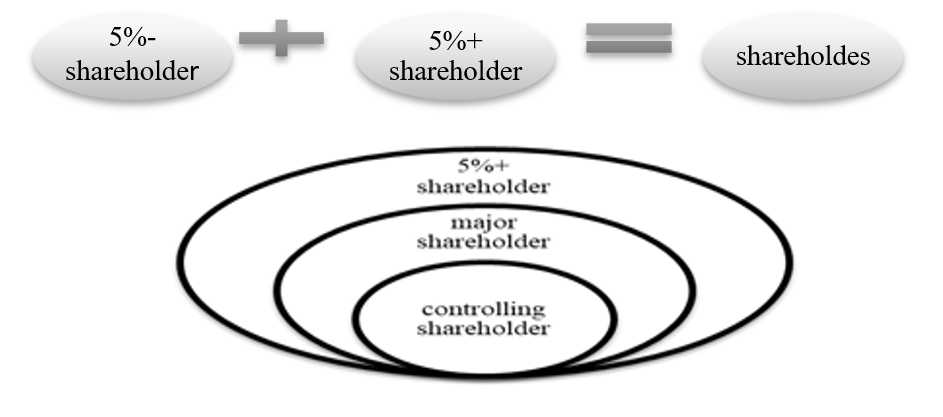

Shareholders generally can be classified into four types, namely the shareholder holding less than 5% of the equity in a security company (“5%- shareholder”), the shareholder holding 5% or more (“5%+ shareholder”), the major shareholder and the controlling shareholder.

The major shareholder means a shareholder that holds over 25% of the equity or the biggest shareholder that holds over 5% of the equity, while the controlling shareholder is a shareholder that holds over half of the securities company’s equity, or has sufficient voting rights to exert a significant impact on the resolution proposed at the shareholders’ meeting in the securities company, although the equity it holds is less than 50%.

- Standard Requirements

Such requirements can be classified into several groups.

|

Group |

Requirements (high-level summary) |

|---|---|

|

One |

|

|

Two |

|

|

Three |

|

|

Four |

|

|

Five |

|

|

Six |

|

The shareholder and actual controller shall meet different eligibility requirements under different scenarios (e.g., different category of securities companies).

|

Shareholder / Actual Controller |

Eligibility Requirements |

|

|---|---|---|

|

5%- shareholder |

Group One |

|

|

5%+ shareholder |

Group One and Two |

|

|

major shareholder |

comprehensive |

Group One, Two, Three and Five |

|

specialized |

Group One, Two, Three |

|

|

controlling shareholder |

comprehensive |

Group One, Two, Three, Four, Five and Six |

|

specialized |

Group One, Two, Three and Four |

|

|

actual controller of 5%+ shareholder |

Group One, Group Two (excluding item (d)) |

|

|

actual controller of the securities company |

Group One, Group Two (excluding item (d)), Group Three (only item (d)), Group Four (only item (b) and (c)) |

|

- Special Requirements for Shareholders

In addition to those “Standard Requirements”, there are further requirements for shareholders in some special forms. For example, if the shareholder is a limited partnership, it shall not hold 5% or more of the equity, unless recognized by the CSRC, and its GP responsible for the execution of the limited partnership’s affairs shall meet the “Standard Requirements”.

- Additional Requirements for Foreign Shareholders

In addition to those “Standard Requirements” and the “Special Requirements” (if applicable), a foreign shareholder shall further meet the following requirements.

- Its home country or region has in place thorough securities-related laws and regulatory systems, and the relevant financial regulator has concluded a MOU with the CSRC with respect to collaborative efforts in securities regulation, and maintained a constructive regulatory partnership with the CSRC;

- It is a legally incorporated financial institution in its home country or region, and all of its financial indicators have, for the last three years, conformed to the legal requirements and requirements of the regulator, applicable in its home country or region;

- It has engaged in securities business for over five years, and has neither received any serious penalty from a regulator, an administrative authority or a judicial authority in its home country or region, nor been subject to investigations brought by relevant authorities into its suspected serious violations, within the last three years;

- It has in place sound internal control systems; and

- It enjoys a good global reputation and has satisfying business performance, and its business scale, income and profits have remained top in the world in the past three years, with its long-term credit standing maintained at a high level in the last three years.

Section VBusiness Scope

According to the PRC Securities Law, upon approval by the CSRC, a securities company may undertake some or all of the following securities operations: (1) securities brokerage; (2) securities investment consulting; (3) financial advice services relating to the activities of securities trading or securities investment; (4) underwriting and sponsoring issues of securities; (5) securities margin trading; (6) market making of securities; (7) proprietary securities investment; and (8) any other securities business activity. A securities company that engages in the management of securities assets shall comply with the laws and administrative regulations such as the PRC Securities Investment Fund Law.

However, for foreign-invested securities companies, there are some further requirements. Compared with previous rules, applicable new rules in effect since 2018 allow foreign-invested securities companies to engage in much more types of business (please refer to a comparison in the table below).

|

Previous Rules |

New Rules |

|---|---|

|

Foreign-invested securities companies may engage in the following business activities:

|

Only one principle requirement:

The initial business scope shall be commensurate with the controlling shareholder’s or the biggest shareholder’s experience in securities business.

|

Further, according to the Interim Provisions on the Examination and Approval of the Business Scope of Securities Companies, which is applicable to both domestic and foreign-invested securities companies, for a newly-established securities company, no more than four types of business can be approved by the CSRC. Please refer to the table below for a summary of business scope of securities companies newly approved by the CSRC in recent two years.

|

Securities Company |

Business Scope |

|---|---|

|

JP Morgan |

securities brokerage, securities investment consulting, proprietary investment of securities, underwriting and sponsoring of securities |

|

Nomura |

securities brokerage, securities investment consulting, proprietary investment of securities, securities asset management |

|

Jinyuan President |

securities brokerage, proprietary investment of securities, underwriting and sponsoring of securities |

After the establishment of a securities company, it may apply for addition to its business scope after meeting certain eligible requirements.

Section VIRegistered Capital

According to the PRC Securities Law, the registered capital shall commensurate with the business scope, and it shall be paid up when the securities company is established. The shareholder shall invest with its proprietary capital.

|

Business Scope (as enumerated in Section V) |

Minimum Registered Capital (RMB) |

|---|---|

|

Item (1) to (3) |

50,000,000 |

|

Any one of item (4) to item (8) |

100,000,000 |

|

Any two or more of item (4) to item (8) |

500,000,000 |

Section VIIShareholding Norms

A shareholder can invest in two securities companies at most, among which it is allowed to control only one.

The equity held by the controlling shareholder and other shareholder(s) shall be subject to a 60-month and 36-month lockup period respectively. Whereas, if the securities company has no controlling shareholder or actual controller, the equity held by all shareholders shall be subject to a 48-month lockup period. Equity transfer between two entities under the same control is exempted from such restriction.

Section VIIICompany Establishment Procedures

|

Steps |

Introduction |

|---|---|

|

Application with the CSRC for Company Establishment |

The CSRC will review all application documents (including a legal opinion issued by a PRC law firm) and decide on whether to approve within 6 months in principle. |

|

Company Registration |

With approval by the CSRC, the shareholders shall register the securities companies with local market regulation authority and obtain the business license within 6 months.

After implementation of the PRC Foreign Investment Law in 2020, we understand that the securities company does not need to obtain the approval certificate for foreign-invested company from the Ministry of Commerce (“MOFCOM”) anymore although relevant rules jointly issued by the MOFCOM and the CSRC have not been formally repealed. |

|

Application with the CSRC for Securities Operator License |

Within 15 days after obtaining the business license, the securities company shall apply with the CSRC for the securities operator license. |

Section IXOutlook

CSRC resumed reviewing application for establishment of domestic securities companies in 2019, which was an end to many years’ suspension. Currently, there have been only a small number of foreign-invested securities companies in China mainly because such companies are subject to foreign ownership and business scope limitation under previous rules and now such obstacles have been cleared. With the business sector is opening to both domestic and foreign-invested securities companies, it is expected more securities companies will be established.

However, it does not mean that there is no limit on the number of securities companies being established. According to the Regulations on the Supervision and Administration of Securities Companies and relevant administrative guidance issued by the CSRC, when deciding whether to accept the application for securities company establishment, the CSRC shall consider it from the perspective of securities market development and fair competition. That is to say, the CSRC has the discretion based on the prudent regulation principle. Therefore, any institution that intends to establish a securities company is suggested to make the arrangement as soon as possible.

* * * * *

Please kindly note that this Memo is rendered mainly with respect to relevant laws and regulations of the PRC (for purposes of this Memo only, the PRC does not include Hong Kong, Taiwan or Macau) in effect as of the date of this Memo. This Memo is being furnished solely to you on a confidential basis for your reference purposes only.

Jingtian & Gongcheng Investment Funds & Asset Management Group has vast experience with setting up various foreign-invested financial institutions, asset management companies and other regulated entities in the PRC, including but not limited to mutual fund management companies, FMC subsidiaries, private fund management companies, securities companies, wealth management companies and QFLP/QDLP/QDIE fund managers. In September 2019 and March 2020, Jingtian & Gongcheng received international recognition by garnering the China Investment Fund Law Firm of the Year Award from China Law & Practice and Asia Firm of the Year from The Asian Lawyer under leading international legal publishing group ALM, respectively.

Should you have any further questions, please feel free to contact Messrs. James Yong Wang and Eric Ye Zou below.

[1] It refers to the Closer Economic Partnership Arrangement between Mainland China and Hong Kong/Macao Special Administrative Region.