*本文首次刊发于2021年第3期《Juriste International》。该刊物由国际律师联盟(International Association of Lawyers)与LexisNexis联合创办。

For foreign investors investing in Africa, the investment laws or natural resource laws of many host countries extensively incorporate localisation requirements, that is, requiring employment and training of a certain percentage of local manpower, local purchase of raw materials and services, and a certain percentage of local or state ownership in special sectors, etc. The above localisation requirements are generally reflected in the preferential tax policies or conveniences under the investment laws of the host countries, but may be made as mandatory legal requirements in some special sectors (such as mining, oil & gas, and other natural resources). For example, both the Democratic Republic of the Congo (“DRC”) and the Republic of Guinea (“RoG”) stipulate that a company holding mining rights must have a certain percentage of its shares held by the State or local natural or legal person(s), and must employ a minimum percentage of local employees. In addition, the 2018 DRC Mining Code also incorporates the social obligations undertaken by mining companies in the form of “Cahier des charges” as one of the conditions for the effectiveness of a mining right, and requires mining companies to purchase goods and services from subcontractors with legal qualifications. Foreign investors in mining projects need to actively respond to such mandatory legal requirements, adjust their overall investment plan and corresponding costs and expenditures flexibly, and maintain and maximize their benefits through plan of arrangement and the management structure of joint venture while promoting the operation of the project in compliance with laws and regulations.

In overseas investment, foreign investors are increasingly faced with the concept of localisation embodied in the laws and policies of the host countries. Localisation is a strategy to promote the growth of the community where a company operates, improve productivity, reduce long-term costs and ultimately serve the capacity building of the host countries through human resources development, supply chain development, establishment of partnership with local organizations and infrastructure construction.

Under the framework of localisation strategy, for general sectors, the investment laws of many African countries will offer preferential tax policies or investment conveniences for the investment projects which employ local manpower, purchase raw materials and services locally or relate to local people's livelihood, or the investors who satisfy specific conditions.[1] While for some special sectors, especially mining, oil & gas and other natural resources, national legislations may set forth mandatory legal requirements on the above investment activities and even the shareholding percentage of investors.

It is also one of the key points in compliance to which foreign investors should pay high attention when operating investment projects in Africa, to satisfy the legal and regulatory requirements on localisation or local content and, more generally, the sustainable development strategies of African countries. Based on our project experience, we will focus on the mandatory legal requirements of DRC and RoG in the mining sector concerning the State or local ownership via natural person(s), as well as the requirements for mining companies to undertake social obligations, select and use local subcontractors and employ a minimum percentage of local employees, and their respective impact on foreign investors, and propose possible preventive measures.

I. Requirement for State or Local Ownership in Mining Companies

In order to increase the income and management participation of the host country and the natural persons with the nationality of the host country in mining projects and strengthen the host country’s control over its natural resources, the laws of the host country will stipulate that the State and local people shall have a certain shareholding percentage in mining companies, so as to (i) ensure that the host country and local people benefit from the return on equity of mining projects, enabling dividend income from mining projects to the host country in addition to taxation; and (ii) cultivate the middle class in the host country by means of dividends, to establish a relatively complete social structure, to maintain social stability.

(I) DRC

For foreign investors investing in the mining sector of the DRC, it is necessary to pay high attention to the mandatory legal requirement in the Law N° 007/2002 of July 11, 2002 relating to the Mining Code as modified and supplemented by Law N° 18/001 of March 09, 2018 (“DRC Mining Code”) and the Decree No. 038/2003 of 26 March 2003 on Mining Regulations as modified and supplemented by Decree N° 18/024 of June 08, 2018 (“DRC Mining Regulations”), both revised in 2018, for the DRC or DRC natural person(s) to have a certain shareholding percentage in a mining company. Such mandatory legal requirement is the primary challenge faced by foreign investors when investing in the mining sector of the DRC.

Specifically, Congolese natural person(s) shall hold at least 10% of the registered capital of a mining company. At least 50% of the registered capital of a company which has no mining right but engages in mineral processing and smelting shall also be held by Congolese national(s).

And it is also the intention of the DRC Mining Code to increase the interest of the DRC Government in mining projects. The Mining Code requires that when applying for a Mining Permit (Permis d’exploitation, “PE”), Mining Permit for Tailings (Permis d’exploitation des rejets, “PER”) or Small-scale Mining Permit (Permis d’exploitation de petite mine, “PEPM”), a DRC company shall transfer 10% equity or shares to the DRC, which shall be acquired by the DRC Government on a free-carry and non-dilutive basis. On the transfer of a PE, PER or PEPM, the transferee shall assume all the obligations of the transferor towards the DRC in respect of such permits held by the transferor, in particular the above obligation to transfer 10% equity or shares to the DRC on a free-carry basis. Moreover, at the renewal of the PE or PER, the mining company must transfer another 5% equity or shares to the Government on a free-carry and non-dilutive basis.

After the implementation of such mandatory requirements of the DRC Mining Code and the DRC Mining Regulations, the statutory shareholding percentage of the DRC Government and Congolese in a mining company can reach up to 25%, which has a significant effect on the investment project of foreign investors both before and after the implementation of the new mining laws. For specific projects, foreign investors need to reconstruct financial models in response to the adjusted equity ratio, measure the economic feasibility of mining projects, and readjust and negotiate commercial cooperation conditions of mining projects according to the implementation of the new mining code and regulations.

(II) RoG

Article 150-I of Act L/2011/006/CNT of 09 September 2011 enacting the Mining Code of the Republic of Guinea (“RoG Mining Code”) provides that, “the grant by the State of a Mining Operation Permit immediately gives the State an ownership interest, at no cost, of up to a maximum of fifteen percent (15%), in the capital of the company holding the Title”. Such ownership interest of the State may not be diluted in subsequent capital increase of the company, and is free from all encumbrances; and may neither be sold, nor be subject to pledge or mortgage. It confers on the State all other rights conferred on to shareholders by the OHADA Uniform Act relating to Commercial Companies and Economic Interest Group (which is also the Company Law applicable in RoG).

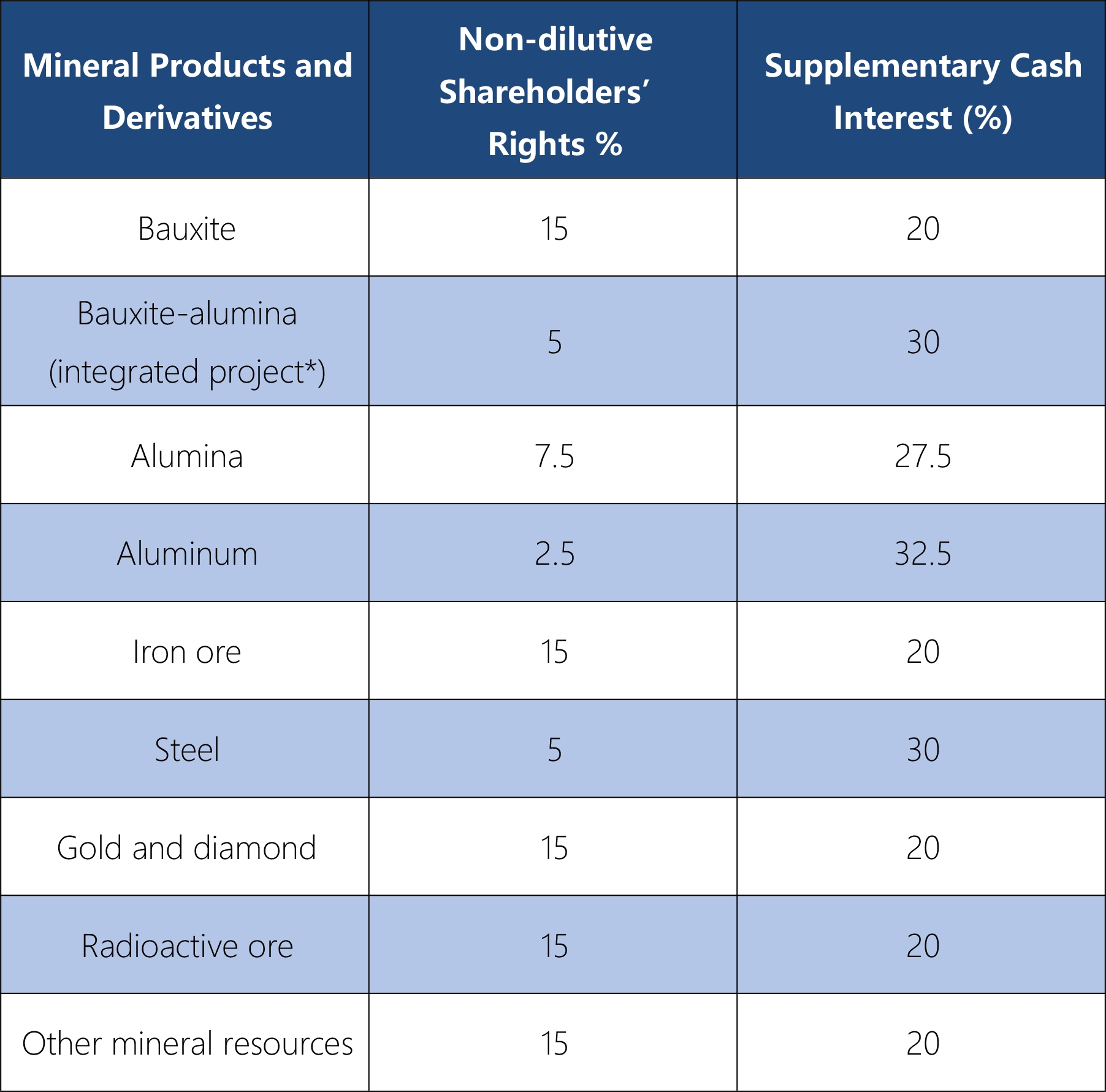

The State has the right to acquire a supplementary participation, in cash, according to the terms agreed with each relevant mining company within the scope of the Mining Agreement. This acquisition option may be scheduled over time, but may be exercised only once. According to Article 150-I of the RoG Mining Code, the total participation held by the State under such Article shall in no case exceed thirty-five percent (35%) of the total share capital of the mining company. Such supplementary participation varies for different types of natural resources involved.

The table below defines the levels of State participation in the capital of companies holding a Mining Operation Permit by mineral substance within the limit of thirty-five percent (35%) (Article 150-I of the RoG Mining Code).

* financing of a bauxite mine and an alumina refinery.

(III) Summary

Due to the particularity of mineral resources, in addition to the financial benefits from mining projects through taxation, the host governments also acquire extra financial benefits from the mining projects by compulsory participation in the mining projects. Besides, it assists the political demands of cultivating the middle class, optimizing the social structure and stabilizing the people and society in the host countries in regards to their political demand by compulsory local participation in mining projects.

Foreign investors need to fully understand the above demands of the governments, make forward-looking prediction of the possible legal risks as the host governments and local people may increase their shareholding in mining projects according to the changes in the political landscape of the host countries, allocate such risks in advance in relevant transaction documents and fully take into consideration these risks in the process of implementation the mining project.

II. Local Community Contribution Requirements for Mining Companies

With regard to mining right projects, Chapter IV, Title X of the DRC Mining Code stipulates a series of social responsibilities for holders of mining rights for exploitation (including PE, PER, PEPM) and Authorization for Permanent Quarry Exploitation (Autorisation d’exploitation des carrières permanente, “AECP”), so as to promote the socio-economic and industrial development of local communities affected by their mining activities. Undertaking such social responsibilities mainly requires mining companies to prepare and implement the “Cahier des charges” to be signed with local communities according to the timetable, and pay social contributions due on earnings.

First of all, mining companies shall prepare and sign the Cahier des charges within the statutory time limit according to the procedures and templates stipulated in the DRC Mining Code, and submit the signed Cahier des charges to the Provincial Mining Department for review and approval. The Cahier des charges serves as a written document setting down the commitment of a mining company to construct socio-economic infrastructure and provide social services to local communities affected by its mining activities, and shall clearly define the scope of local communities affected by the mining project, and put forward the plan, timetable and corresponding capital investment of any project for local infrastructure construction and education development. Failure to fulfill the social responsibilities according to the timetable set forth in the Cahier des charges constitutes one of the grounds for the revocation of mining rights stipulated in the DRC Mining Code, and is regarded as a violation of commitments and will lead to punishment according to relevant laws and regulations.

Secondly, based on the principles of transparency and traceability in the mining sector, the DRC Mining Code also requires mining companies to appropriate a fund of at least 0.3% of their earnings to support the development of the project community, which will be managed and operated by a legal entity composed of representatives of the mining right holder and local communities directly related to the project. The DRC Mining Regulations clearly specifies that, such legal entity shall consist of representatives of local communities, basic community organizations, mineral right holders, local administrative authorities, the National Fund for Social Promotion and Services (Fonds National de Promotion et de Service Social) and the Mining Environmental Protection Department (Direction de Protection de l'Environnement Minier), subject to the authority and operational procedures set forth in the procedure manual approved by a joint decision of the ministers of government departments in charge of mining and social affairs. Failure to fulfill this obligation is also an act of failure to fulfill social responsibilities, which also constitutes one of the grounds for the revocation of mining rights stipulated in the DRC Mining Code.

The above community contribution obligation is a new requirement added by the DRC Government when revising the DRC Mining Code in 2018. In fact, the reason for the revision of the Mining Code in 2018 is obvious. As the previous DRC Mining Code was silent on the Cahier des charges that stipulates the social and environmental obligations of mining participants to local communities, the legislator expects to make it up through this amendment. Such new requirement reflects the importance attached by the DRC Government to the sustainable development of local communities and its determination to ensure that local communities benefit from mining projects through legislative means. Accordingly, mining companies also need to pay more attention to the promotion role of mining activities to the development of local communities, and regard them as an important part of mining projects and incorporate them into the consideration of their business plans.

III. Localisation Requirements for Subcontracting Activities

The large number of mining projects invested by foreign investors in the DRC has given birth to the demand for mineral products processing, infrastructure construction, technical and management services. In this regard, the DRC Mining Code requires companies that provide subcontracting services to mining companies to comply with the provisions of the subcontracting laws of the DRC, mainly the Law N°17/001 on Subcontracting in the Private sector of 8 February 2017 (“Subcontracting Law”) and the Decree N°18/018 on the application measure of Subcontracting law of 24 May 2018 as modified and supplemented by Decree N°20/024 of 12 October, 2020 (“Subcontracting Implementation Decree”).

As indicated in its explanatory statement, Subcontracting law aims to correct the long – standing unequal distribution of wealth in favor of foreign investors (whether directly through the local subsidiaries of multinationals or indirectly through Congolese companies with foreign capital), mainly in the mining, hydrocarbons, construction and telecommunications sectors. This situation leaves no space for Congolese companies with Congolese capital consisting mainly of small and medium-sized enterprises, causes at the same time a shortfall in public revenue, and hinders the promotion of the employment of Congolese as well as the emergence of national expertise.

Thus the present Subcontracting law is enacted to make it compulsory to engage related subcontracting activities or ancillary to the main activity to Congolese-owned companies with Congolese capital, in order to promote and foster the emergence of a Congolese middle class. It pursues the protection of the workforce working in subcontracting companies, job creation for national funds and the expansion of the tax base for the benefit of the public revenue. For regulating the subcontracting sector and implementing relevant legal rules, a public institution named Regulatory Authority for Subcontracting in the Private Sector (Autorité de régulation de la sous-traitance dans le secteur privé, “ARSP”) has been established according to Decree No.18/019 of 24 May 2018 on the creation, organization and functioning of ARSP.

As a general rule, according to articles 5 and 6 of the DRC Subcontracting Law, only companies promoted by Congolese nationals and with predominantly Congolese capital (entreprises à capitaux congolais promues par les congolais), regardless of the corporate form, domiciled in the DRC and incorporated under the DRC laws are allowed to engage in subcontracting activities. As an exception to the above, if the DRC lacks the required technical know-how or the required technical know-how is not available in the DRC, the employer may seek to subcontract the same to a foreign company, provided that the foreign company may not provide the subcontracted services in the DRC for more than six (6) months. In such case, the employer shall first proceed with the tendering and bidding process, at the end of which, demonstrate to the competent subcontracting authority that it is unable to obtain the required technical know-how from the subcontractors in the local market. The rules regarding the above-mentioned exception is further specified in the Ministerial Order N°03 Of January 6, 2021 on the Procedures for the Management of Derogations from The Provisions of Article 6 of the Subcontracting Law, which require basically preliminary approval of the general director of ARSP.

Such foreign company is required to establish a company that satisfies the above requirements of the DRC Subcontracting Law if the subcontracting activity lasts for more than six (6) months. The Subcontracting Implementation Decree refines the above standards, explicitly requiring that:

(i) majority of the registered capital of the company shall be held by natural or legal person(s) in the DRC,

(ii) majority of the management organs of the company shall be led by Congolese nationals, and

(iii) the employees of the company shall be mainly composed of Congolese nationals.

As far as the specific percentage of majority of the registered capital mentioned above is concerned, according to Article II of the Press Statement of August 26, 2019 of the ARSP of the DRC, “at least 51% of the registered capital of the legal person proposed to engage in subcontracting activities shall be held by natural or legal person(s) in the DRC in the private sector (and for such legal person(s), majority of their registered capital shall be controlled by Congolese national(s))”.

And, as defined in paragraph 48, Article 1 of the DRC Mining Code, any subcontracting company that provides goods, services or construction activities (especially including industrial, administrative, social and cultural infrastructure construction and other services directly related to mining projects) for mining activities of mining companies, shall also satisfy the requirements of the DRC Subcontracting Law that natural or legal person(s) of the DRC shall hold a majority stake in the company. In addition, the DRC Mining Regulations clearly stipulate that if a mining company engages a qualified geological institute to carry out exploration activities and prepare a feasibility study report, the selection of such geological institute shall comply with the provisions of the DRC Subcontracting Law, and a foreign geological institute must have permanent representative office in the DRC and apply to the Minister of Mines for qualification in accordance with the provisions of this Decree. If a foreign institute is not registered as a Congolese company, it must partner with one or more Congolese professional institutes, companies or firms.

For violations of the aforementioned legislative provisions, the DRC Subcontracting Law provides for penalties in the form of a fine from 10,000,000 to 50,000,000 francs Congolese, a temporary closure of the main contractor not exceeding six (6) months and nullity of subcontracts. The temporary closure of the main contractor is taken, at the reasoned request of the ARSP and as the case may be, by decree of the Ministers having the Economy, Industry and Small and Medium Enterprises in their attributions, by decree of Provincial Governor or by decision of the local administrative authority. The above-mentioned authorities are required to notify their orders or decisions to the ARSP within seven (7) days, for application. The nullity of a subcontracting contract is pronounced by the competent judge, seized by the ARSP within fifteen (15) days from the acknowledgement of the facts.

In practice, some foreign investors in the mining sector will arrange related-party transactions in the process of purchasing materials and services for the sake of management convenience and cost optimization, in some of which the suppliers involved may not satisfy the above qualification requirements for subcontractors. As the DRC Government gradually strengthens the enforcement of subcontracting laws in the future, it will also directly affect the overall commercial arrangements for foreign investors to implement their mining projects.

IV. Local Manpower Percentage in Mining Sector

Investment laws in most African countries require foreign investors to employ local manpower to some extent, or create more jobs by imposing restrictions on the employment percentage of employed foreigners (including jobs prohibited from employing foreigners), so as to improve the skills, productivity and competitiveness of the local manpower, and indirectly promote labor mobility and improve the quality of life of the labor force.

(I) DRC

The labor laws and regulations of the DRC mainly specify the employment percentage of foreign workers, the jobs prohibited from employing foreign workers (in other words, reserved for Congolese nationals), the special taxes and charges required for employment, and the employment permits and work visas obtained by foreign workers.

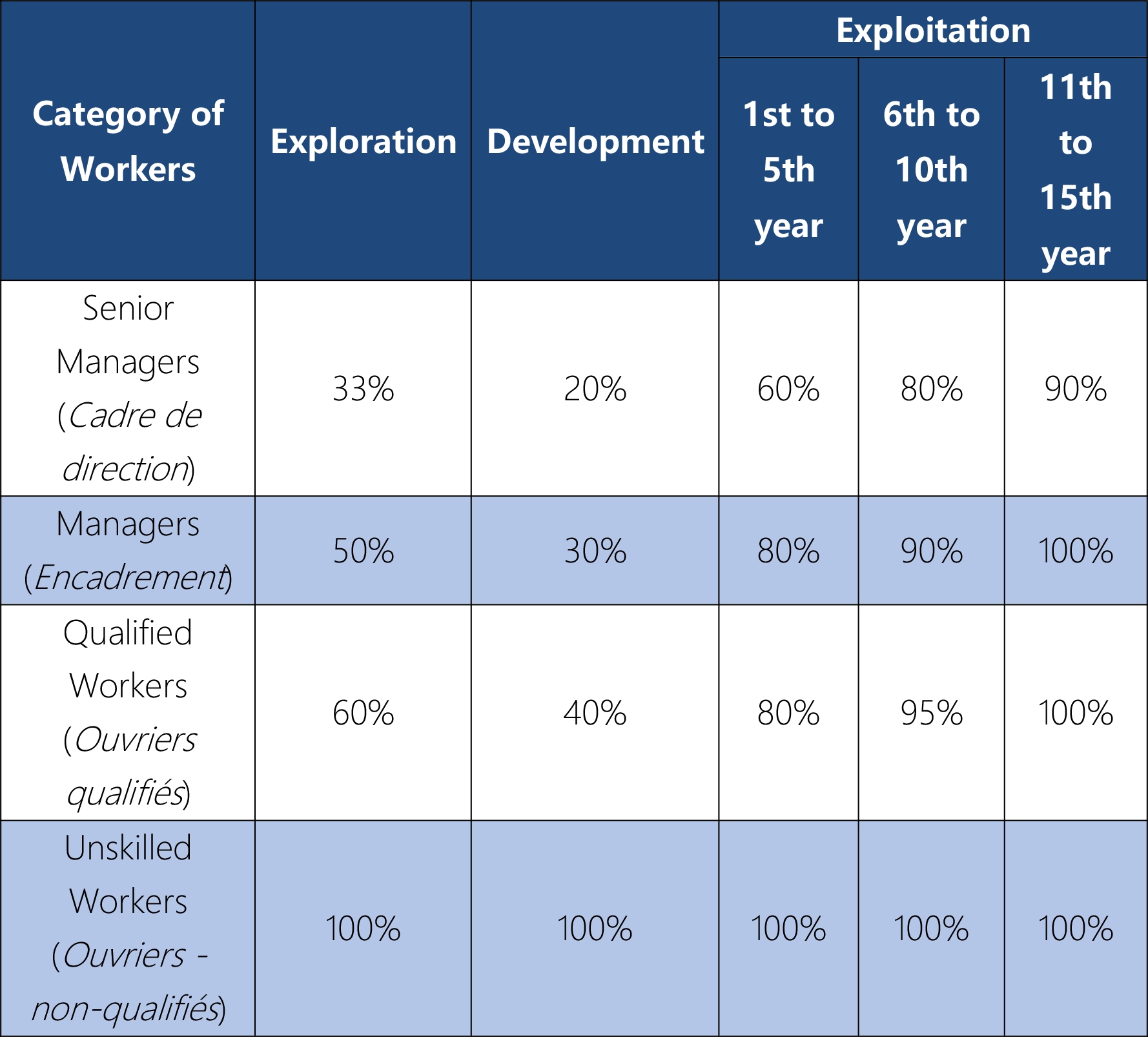

In the mining sector, the special percentage restrictions on foreign workers to be followed by mining companies are mainly set forth in the Mining Regulations. Holders and farmees of PE or AECP, and processing or smelting entities are subject to labor legislation on employment, in particular the regulations on the employment percentage of foreigners (jobs prohibited from employing foreigners), as well as rules and regulations governing the conditions of employment of foreigners. Congolese nationals with the same competence shall be employed on a priority basis by the holders and farmees of PE or AECP, and holders of special license for processing or transformation. Moreover, the Mining Regulations also specify in detail the minimum percentage of Congolese employees employed by mining companies in the exploration, development and construction, and commercial production stages as senior managers, front-line managers, qualified workers and operators. And the percentage of Congolese employees shall gradually increase with the progress of mining projects.

(II) RoG

For companies operating in general sectors such as infrastructure, the RoG Investment Code neither imposes restrictions on the nationality of senior managers, nor requires local directors. However, in the mining sector, the RoG Mining Code requires companies holding mining rights to appoint Guinean managers, which however is not applicable to the companies that do not hold mining rights and only engage in mining subcontracting.

In this regard, Article 108 of the RoG Mining Code specifies that, Guinean managers having the required skills shall be employed on a priority basis by the holders of the Mining Permit or Authorisation (instead of subcontractors working for it). As a result, a holder of the Mining Permit or Authorisation shall, during the development phase, file with the Ministry in charge of Professional Training and with the Mining Administration a training plan for Guinean managers to enable them to acquire the skills required for the management of a company and take managerial positions in the first five years from the date of the start of commercial production. In particular, as of the Date of First Commercial Production, the Assistant Managing Director of the holder of the Mining Permit or Authorisation must be a Guinean national with the required skill to fulfill this role, recruited by the company according to its own procedures. At the end of a period of five (5) years from the Date of First Commercial Production, the Managing Director of the mining company at the exploitation stage must be Guinean with the skills required to hold this position, recruited by the company according to its own procedures.

According to Article 108 of the RoG Mining Code, the holder of a Mining Permit or Authorisation and companies working for its benefit are required to exclusively employ Guineans for all unskilled positions. The management of the holder of the Mining Permit or Authorisation may reserve certain unskilled positions for members of the Local Community.

Article 108 also specifies the minimum quota of Guinean employees of each category to be employed by the holder of the Mining Permit or Authorisation (instead of subcontractors working for it) for each stage of the evolution of the project (i.e. exploration, development and exploitation), specifically as follows:

Failure to comply with such minimum quotas of Guinean employees will expose the holder of the Mining Permit or Authorisation to a financial penalty.

Besides, Article 109 of the RoG Mining Code requires all holders of Mining Permits or Authorisations as well as companies working for their benefit are required to prepare and submit for the approval of the National Office for Training and Professional Development (ONFPP), (i) a training and development program that encourages to the greatest extent the transfer of technology and skills to Guinean businesses and staff; and (ii) a Guineanization program in accordance with the minimum quotas set out above. And the holders of Mining Permits or Authorisations and the companies working for their benefit must establish a career and progression plan for all employees, notably for those in supervisory and management roles, or for any position requiring particular expertise in compliance with the minimum quotas set out above. Expatriate employees of holders of Mining Permits or Authorisations and those of companies working for their benefit must have a work permit that sets out in advance the number of years during which they must remain with the company. Such period must comply with the RoG laws regarding the entry and exit of foreigners and the RoG Labor Code, and is renewable only once.

Be it the laws and regulations of the DRC or the RoG, the main intention of the mandatory requirement for employment of local manpower is to protect the local labor markets and create more jobs for the host countries. Therefore, foreign investors need to actively respond to the requirement for employment of local manpower, and, employ local employees as much as possible in an organized and planned manner according to the stage of mining project (construction period and operation period), and strengthen the systematic training and education for local employees to improve their professional skills and enhance their competitiveness in the labor markets, so as to ultimately realize the strategic plan of localisation of employees and management, solve the employment problem of the host countries, and effectively achieve the long-term goal of stable social order and promoting development. The virtuous circle so formed will provide a good environment for the sustainable development of mining projects in the host countries, and it is also one of the effective measures for foreign investors to reduce political risks. Foreign investors should pay special attention to the localisation of employees and management.

V. Impact on Foreign Investors and Possible Preventive Measures

For the time being, when investing in projects in Africa, foreign investors often face the constraints of reality and the balance between the compliance requirements of the host country’s laws and regulations and the expected return of investment. Most African countries where investment projects are located are backward in infrastructure construction, lack professional technology, engineering and management skills and talents, and foreign investors will also have to deal with the shortage of raw materials and auxiliary materials needed for construction or mining for their local investment projects from time to time.

Meanwhile, the legal requirements (especially mandatory legal provisions) of the host countries on localisation will have a two-fold impact on foreign investors: on one hand, if foreign investors actively respond to the above legal requirements for localisation, it will help improve the skills of local manpower, promote the development of local society and economy of the host country, and help build a better and more stable social and economic environment for investment projects in the long run; on the other hand, in order to satisfy the above requirements, foreign investors need to pay certain compliance costs and adjust the existing overall investment plan, which may affect the realization of the expected return on investment.

In view of the above, foreign investors should actively respond to the legal requirements of the host governments for localisation, set up joint ventures with local people, retain a certain percentage of free-carry shares held by the governments according to the legal requirements, employ local manpower or managers, and purchase raw materials or services from qualified suppliers. And a foreign investor who is a foreign shareholder of a mining company shall, while complying with the internal approval procedures and compliance requirements of the joint venture and confirming the compliance of the construction and the entity providing goods and services, legally safeguard and maximize its interests through joint venture agreement, shareholder agreement and the management (via control over the company’s management, shareholders’ rights and interests, etc.), so as to ensure that mining projects proceed according to the timetable. In this process, foreign investors should also pay attention to maintaining their cooperation with local shareholders to minimize compliance risks or adverse effects. All these considerations should be taken into account throughout all stages of a mining project, from preliminary negotiations, establishment of a mining joint venture, to operation and commercialization of the mining company.

注释